Unless otherwise defined, all terms and references used herein shall bear the same meanings as ascribed to them in the announcement dated 25 October 2016 and 3 January 2018 in relation to the Proposed Acquisition of 100% stake in Premier, Prestige and Green Management (the “Premier Group”).

The Board of Directors (the “Board’) of Advancer Global Limited (the “Company”, and together with its subsidiaries, collectively the “Group”) wishes to announce that pursuant to mutual agreement in writing between the Vendors and Purchaser (the “Agreement”), the Further Consideration has been determined at S$3.1 million to be satisfied by way of cash.

The Further Consideration was determined based on arm’s length negotiation between the parties on a willing-buyer willing-seller basis. In arriving at the amount of Further Consideration, the Board had evaluated Premier Group’s performance from the period of transfer of Premier Group shares to the Group (being 1 November 2016) to 31 December 2017.

In addition, the Board has also taken into account, inter alia, Premier Group’s customer base, net asset value, financial track records and its future growth potential, in determining the Further Consideration. Accordingly, the Proposed Acquisition has been completed. The Board is of the view that its decision on arriving at the amount of Further Consideration and the payment through internal resources, is in the best interest of the Group.

Relative Figures Under Chapter 10 of the Catalist Rules

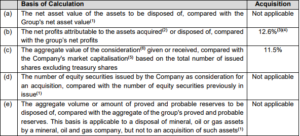

The relative figures for the Acquisition pursuant to Rule 1006 of the Listing Manual Section B: Rules of Catalist of the Singapore Exchange Securities Trading Limited (“Catalist Rules”), based on the Company’s latest announced unaudited consolidated financial statements for the first six-month financial period ended 30 June 2017 (“HY2017”), are as follows:

Notes:

(1) This basis is not applicable to the Acquisition.

(2) Pursuant to Rule 1002(3) (b) of the Catalist Rules, “net profits” is defined as profits before income tax, minority interests, and extraordinary items.

(3) The net profit attributable to Premier Group for the 6-month period ended 30 June 2017 is S$328,551, which is made up of net profit attributable to Premier and Prestige of S$217,722 and S$115,241 respectively as well as net loss of Green Management of S$4,412. Green Management is currently a dormant company and had not generated any income. The loss incurred by Green Management is due to the expenses for audit fees and corporate secretarial services.

(4) The net profits of the Group for HY2017 amounted to approximately S$2,599,000.

(5) The market capitalization of the Company amounting to S$52,916,688 is determined by multiplying the number of issued shares, being 185,672,589 shares, by the volume weighted average price of such shares transacted on 31 January 2018 of S$0.285 per share (being the last market day preceding the date of Agreement on 1 February 2018).

(6) The aggregate value of Consideration is S$6,100,000.

As the aggregate relative figures calculated under Rule 1006(c) of the Catalist Rules exceeds 5% but does not exceed 75%, the Acquisition constitutes a disclosable transaction as defined under Chapter 10 of the Catalist Rules. Accordingly, the Company is not required to seek shareholders’ approval for the Acquisition.